From the report SACE: Focus on Where To Export Map 2024

In recent years, several major topics have raised interest in the public debate: this year we have highlighted those that in our opinion occupy an important place in the current geoeconomy.

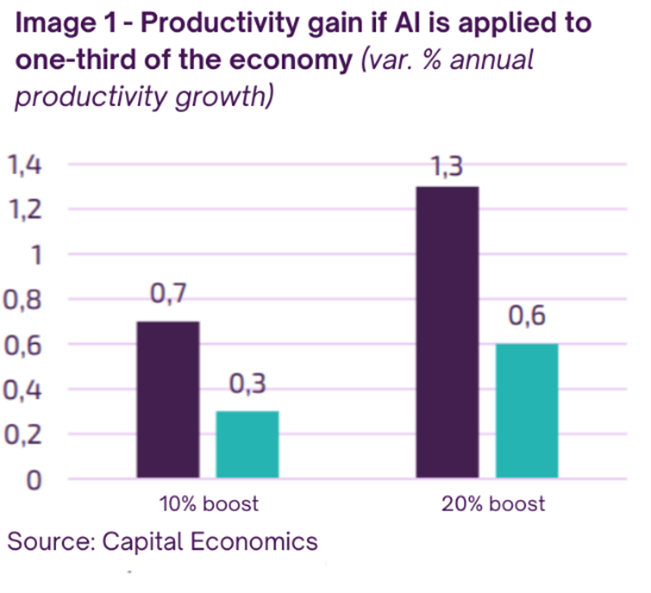

One of the innovative aspects of the "AI revolution" compared to all the previous ones is to the reduction of the time needed to see the first benefits deriving from it. Among the advantages for productivity the most impactful is efficiency savings, while output per worked hour can increase through the growth of three factors: the amount of capital per worker, the quality of the workforce and multifactorial productivity, that is, the efficiency with which labor and capital are combined, for example by promoting the best working practices.

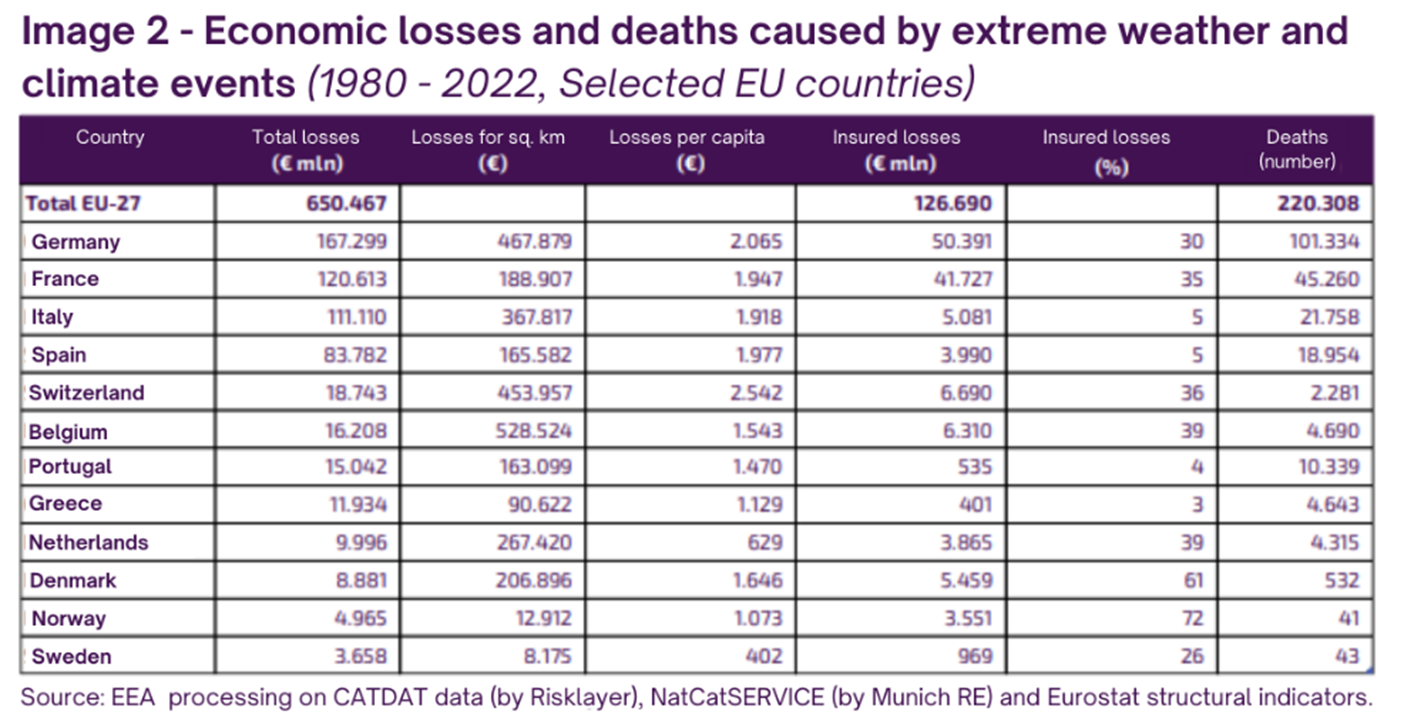

Climate change is an accelerating process that is increasingly materialising into extreme events. These events also have economic impacts, the quantification of which is not easy. According to the European Environment Agency (EEA), economic losses in the European Union caused by extreme weather events between 1980 and 2022 are estimated at €650 billion. Within the EU, the Climate Change Adaptation Strategy aims to promote action at national level, so that Europe becomes a climate change resilient Union by 2050.

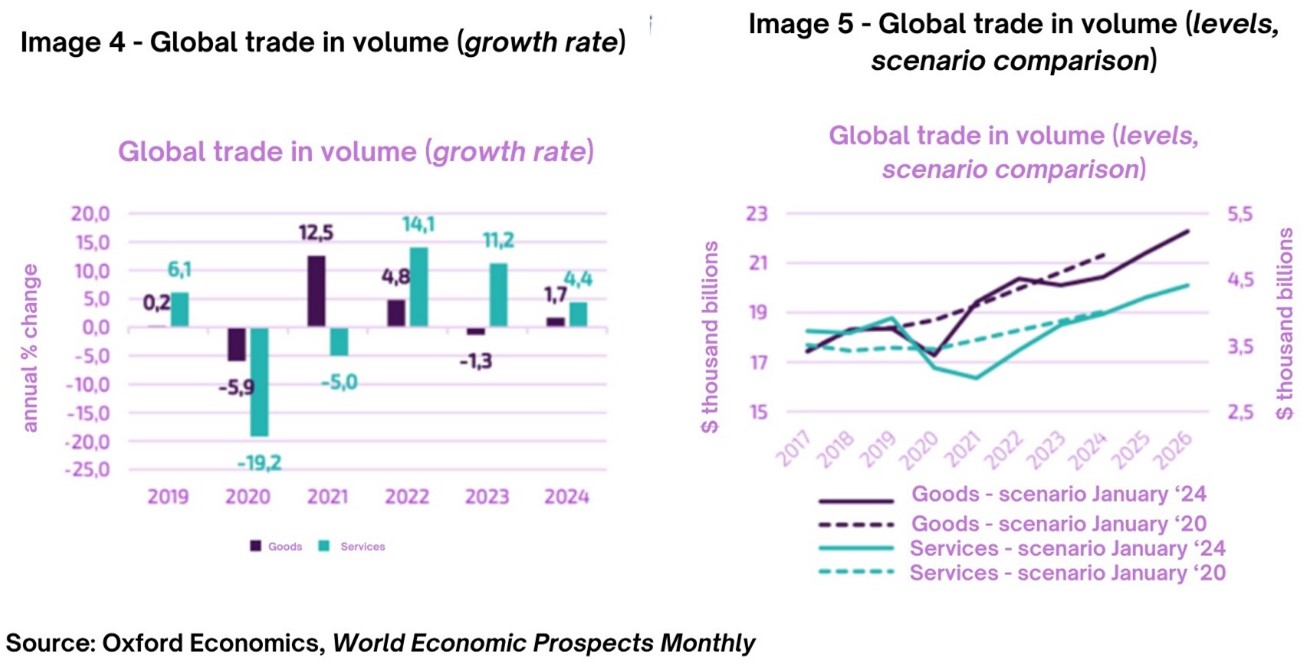

During 2023, world trade in goods decreased compared to the previous year (-1.3% in volume). This decline is explained by the burnout of the strong post-pandemic impulse, along with the shift of consumer preferences towards services. Nevertheless, global economic activity has advanced at a slower pace, especially in the advanced economies which are relatively more open to imports.

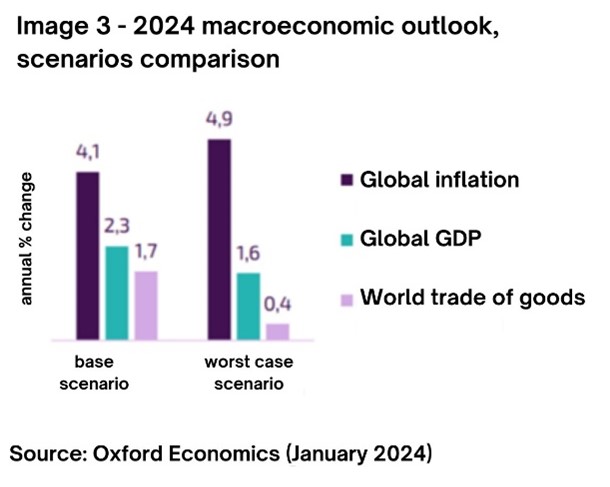

This is added to the exacerbation of geopolitical tensions, which has resulted in a considerable number of new restrictive interventions of world trade in goods. Another factor is the weakness of foreign direct investment (FDI) flows, as a result of tighter monetary policies, high uncertainty and the gradual removal of emergency fiscal policies. However, some of these factors are expected to improve in 2024. Global financial conditions began to ease in the final quarter of last year, driven by higher equity valuations and expectations of key central bank interest rate cuts during 2024. Overall, an improvement in global financial conditions has a positive impact on emerging economies, especially the most indebted foreign exchange economies. It is also true, according to a study by the International Monetary Fund, that this relationship has weakened: this is in part reflected in the recent divergence in monetary policy between advanced economies and emerging markets, the latter of which started on average to ease key interest rates already last year.

The global macroeconomic framework remains exposed to downside risks linked to the renewed conflict between Israel and Hamas and the resulting attacks by Yemeni Houthi militias (supported by Iran) on Western cargo ships in the Bab al-Mandab Strait (as official support to the people of Gaza). Therefore, the world-wide marine transport turns out to be impacted by the criticalities in the Suez Canal, with the passage of cargo ships meaningfully diminished regarding the average of the period in favor of the Cape of Good Hope in South Africa, resulting in an extension of the delivery time of goods (on average about ten days more) and at the same time a surge in shipping costs. The increase of the cost of the marine transport and the times of delivery could cause reductions of the ability to offer of the world-wide economy, holding back the ongoing cooling of the prices.

The overall risk picture shows a slight improvement, especially for credit risks. This is due to the consolidation of some important countries in economic and demographic terms (Brazil, Mexico, India). Moreover, some countries with increasing potential such as Vietnam, Saudi Arabia and Oman are on the rise: the mix between consolidation of the prevailing sectors (manufacturing, raw materials and so on) and diversification policies in favor of "new" sectors (IT, tourism) has given new impetus to the economy with positive repercussions both on the corporate system of countries and on banking systems. However, there is no lack of fragility in countries already weakened by unstable macroeconomic fundamentals (Nigeria, Kenya) or those that are suffering the negative impact of external dynamics such as rising interest rates on public debt (Ghana) or more structural weaknesses (Egypt, Tunisia, Argentina).

Also this year the Export Opportunity Index (EOI) has been updated, the synthetic indicator calculated on about 200 countries, that guides Italian companies in seizing the greatest opportunities in the international field and that gives rise to the Export Map. From this it can be inferred that the countries that present the greatest opportunities for European companies, and consequently Italian, are the United States, the United Arab Emirates, Spain, the Middle East area, Mexico and Brazil.

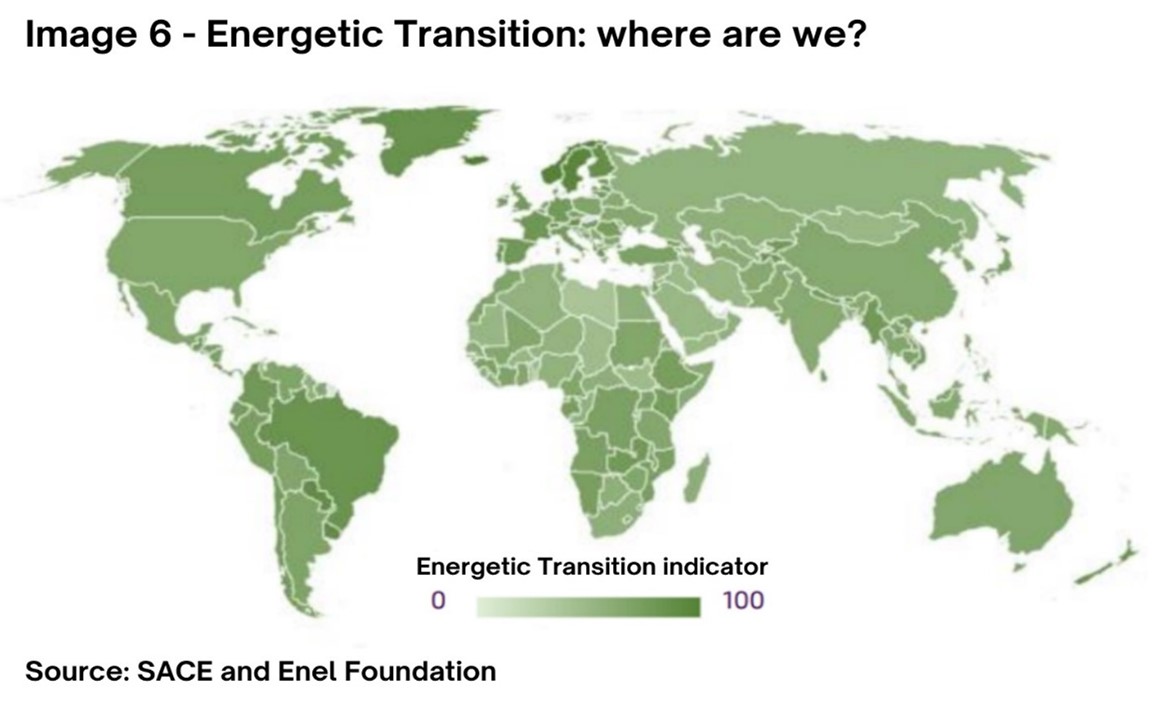

The Energy Transition continues to advance on a global scale and fuels hopes for a significant process of decarbonisation and electrification. The transition is confirmed, in line with the analysis of recent years, now mature and with particularly positive dynamics in Europe (the most virtuous on decarbonisation) and Latin America (high levels of renewable energy, such as wind and photovoltaics). Despite the substantial contribution of public subsidies that favour inefficient energy consumption, the adoption of more modern technologies (like heat pumps) and more virtuous behaviors by companies and consumers seem to drive a global shift. The definition of policies and actions aimed at ensuring a fair distribution of wealth as well as a correct measurement of political-economic risks linked to the progressive erosion of the social contract, composite welfare measures must be defined and recorded.

During 2023, in the countries where the vote was taken as well as in those affected by food crisis and extreme climate events, the need to reduce inequalities has become increasingly clear as a fundamental element for the stability of the country’s systems and guarantee their sustainable development. The Equality indicators continue to place several European countries, especially the Northern and Eastern ones, among the first and, in contrast, many African countries among the last. Health indicators still note the continuing effects of the pandemic and there is a clear polarization between the more advanced and emerging economies. Education is the key to a better future and countries with higher completion rates and better quality of schools and universities are best equipped to face future challenges (again, there is a clear polarization between more advanced and less advanced economies). The Demography indicator, despite its foreseeable short-term stability, shows no substantial changes. Finally, some changes are reported for the Labour indicator, although overall the average of the countries is stable. The main European countries and the United States show rather stable values, unlike some Asian (Armenia, Myanmar and Bangladesh) and African (Eritrea, Ivory Coast and Senegal above all) geographies that improve. On the contrary, the countries that are getting worse and that would definitely need more support in the labour market are Nepal, Rwanda, Zimbabwe and Libya.